Starting Tuesday, Feb. 7, Dixie State University accounting students will offer community members free income tax preparation services.

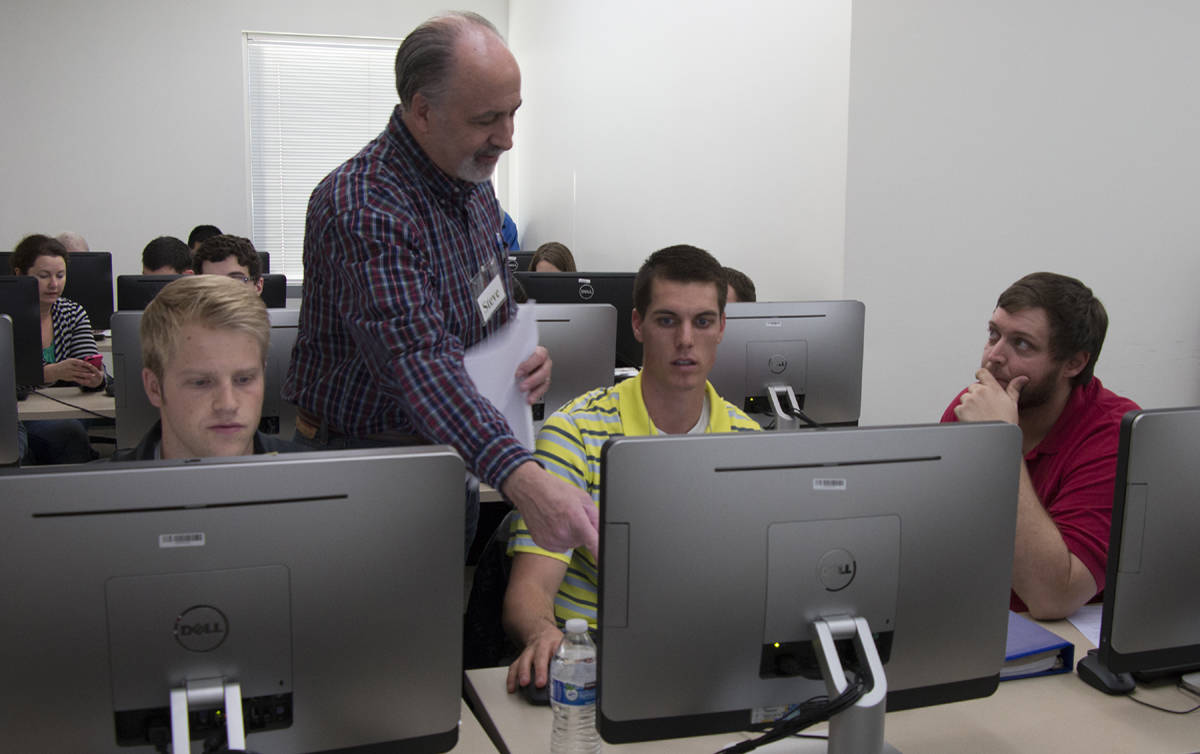

Sponsored by the IRS’ Volunteer Income Tax Assistance program and the Five-County Association of Governments, the program is designed to assist low- and middle-income individuals of all ages on a wide range of tax return scenarios. Additionally, VITA allows students who are certified by the Internal Revenue Service and supervised by DSU faculty who are certified public accountants with IRS certification to gain hands-on learning experience.

“The VITA program has helped our students become engaged in the learning process and has deepened their higher-level learning skills like critical thinking,” said Nate Staheli, DSU accounting department chair. “We have assisted many families with tax refunds to help them with financial needs. In addition, we have and will continue to create a bond with our community because of the service we provide.”

Tax preparation services will be offered from 4 to 8 p.m. on Tuesdays and Thursdays in DSY’s Erno and Etel Udvar-Hazy School of Business, located at 300 S 1000 E. Services will be provided through April 11 but will not be available the week of DSU’s spring break, March 13–17.

Due to IRS restrictions, taxpayers who own businesses, have rental properties, have significant gains or losses on stocks, or have a Schedule K-1 on their tax returns are not be eligible for preparation services through VITA.

Those wishing to have their taxes filed should bring the following items:

—Photo ID.

—Social security cards for each individual appearing on tax returns.

—Wage and earning statements (Form W-2) from all employers.

—Affordable-Care-Act documents (such as forms 1095-A, 1095-B, 1095-C).

—Form SSA-1099 (showing Social Security benefits).

—All types of 1099 forms.

—1099-B forms (accompanied by documentation showing the original asset purchase prices and sales proceeds).

—Form 1098 (documenting mortgage interest, mortgage insurance payments and property tax payments).

—Documentation to verify medical expenses, charitable contributions, child care payments and any other relevant documentation related to income and deductions.

—A copy of their 2015 tax return.

—Bank account and bank routing numbers (both of these can be found on a check; these numbers will be used for automatic deposit of federal and state tax refunds into clients’ checking accounts).

Taxpayers’ completed federal and state returns will be e-filed, free of charge, to the IRS and the applicable states. Clients with multi-state filing needs can be accommodated. Additional information is available at accounting.dixie.edu/vita-free-tax-prep or by emailing vitainfo@dixie.edu.

Articles related to “Dixie State University accounting students offer free income tax preparation”

Dixie State University offers new degree program in political corruption