According to a report released by the Office of the Utah State Auditor (Office) on the State’s expenditures of federal funds, the $4.368 billion in federal funds spent in fiscal year 2014 represents 25 percent of the State’s total fiscal year 2014 and is the State’s largest single revenue source. The report just released covers the State’s compliance with federal laws and regulations governing the use of federal funds.

For the fiscal year, which ended June 30, 2014, Utah received $4.17 billion in federal revenues compared to $2.919 billion in individual income tax and $2.149 billion in sales tax. The difference between federal funds expended and federal funds received is comprised largely of unemployment insurance expenditures which are required to be reported as a federal expenditure. In addition, the State reported another $2.052 billion in federally provided food commodities, loans outstanding, endowments, and loan guarantees for total federal assistance of $6.42 billion.

The Utah State Auditor, John Dougall, states, “Despite the decline in receipt of federal funds received during the economic recession as the economy has slowly recovered, Utah continues to increase its dependence on federal funding over the long term.”

The graph above shows the percentage of Utah expenditures from federal transfers. In fiscal year 1984, approximately 19 percent of Utah’s expenditures came from federal transfers, rising to a peak in fiscal year 2010 at 30 percent. In fiscal year 2014, the percentage fell modestly from that peak to 25%. However, the trend line shows the long-term average, which indicates that Utah’s dependence on federal funds has been increasing for three decades.

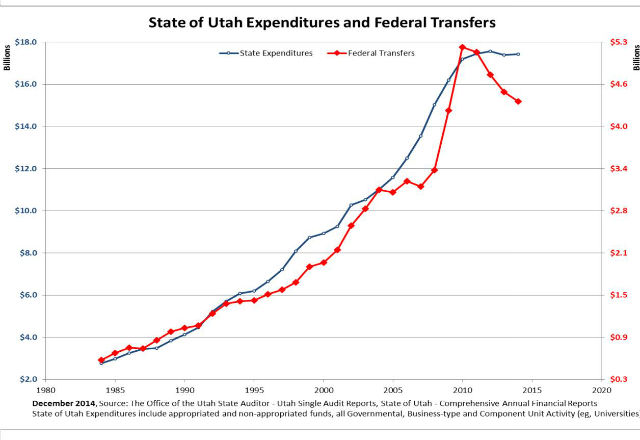

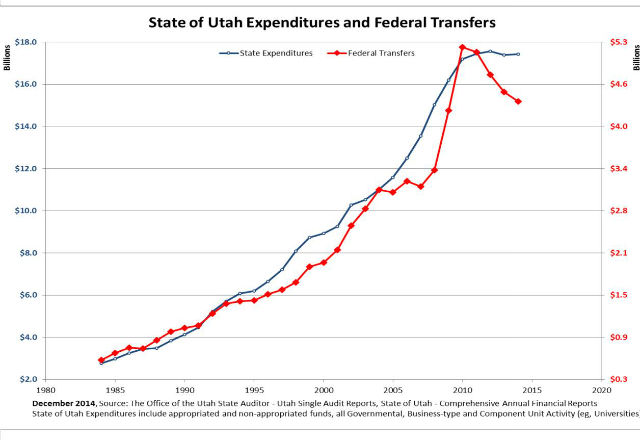

The following graph illustrates the rate of growth of total state expenditures and of federal transfers. State expenditures are shown in blue on the left axis of the graph and federal transfers received by the State are shown in red on the right axis.

Both lines show significant ongoing increases in Utah’s spending.

Overall, the Single Audit for fiscal year 2014 showed targeted improvements in compliance with federal requirements. The Office reported that the State expends federal funds in most respects in compliance with federal regulations. The report presents 44 audit findings, or problems, and recommendations related to the State’s noncompliance with federal laws and regulations and related internal controls. The majority of these findings are modest in scope or impact.

The Office identified areas of modest improvement in this year’s Single Audit when compared to 2013. This year, 2 material weaknesses in internal controls were reported in two federal programs, down from eight material weaknesses in internal controls in six federal programs in fiscal year 2013. Of the 31 federal programs audited for fiscal year 2014, one received a qualified audit opinion because of material noncompliance with federal program requirements. The problem was identified in the National Guard Military Operations and Maintenance Projects.

In particular, the Guard inappropriately charged $431,703 against a budget without having approval for that category of expense, and continued to make those charges even after identifying the noncompliance. The Office recommended that the Guard discontinue these charges until such time that an exemption is granted.

The report includes a detailed list of expenditures for each of the federal programs, as well as a list of expenditures sorted by State department/agency and a list of findings reported during the audit.

A copy of this report can be viewed on our website at auditor.utah.gov and specifically at http://financialreports.utah.gov/saoreports/2014/2014SingleAuditStateofUtah.pdf