Biden Wants High Gasoline Prices

– By Howard Sierer –

The Biden administration is creating massive energy insecurity in the U.S. and taking the rest of the world with us. No matter what one believes about the connection between climate change and burning fossil fuels, it’s madness to intentionally and prematurely create the highest gasoline prices on record when electric cars are far from ready for prime time.

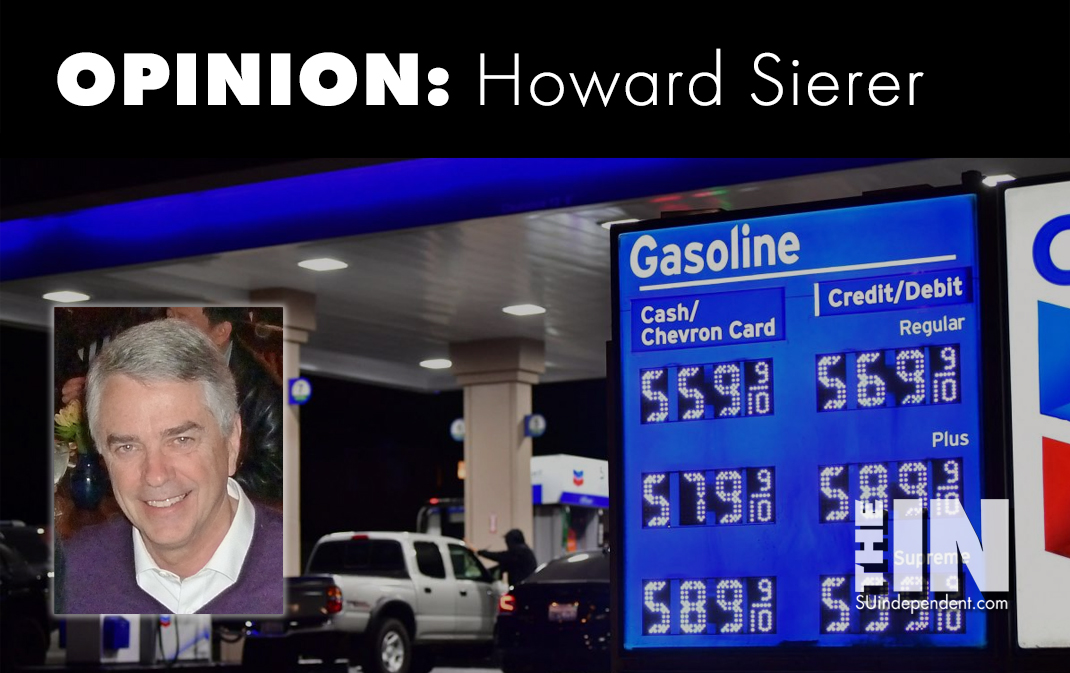

According to the AAA, gas prices going into the Memorial Day weekend averaged $4.60 nationwide compared to $3.04 a year ago. I paid over $5 per gallon in St. George and prices were over $6 per gallon in Los Angeles. J P Morgan expects they’ll be that high nationwide by August.

Putin is giving Biden convenient cover for everything his administration has been doing to stifle oil and gas production in this country. But Biden had domestic fossil fuel production heading down well before Russia invaded Ukraine.

On the campaign trail in 2020, Biden said “We are going to get rid of fossil fuels” and promised to ban all “new oil and gas permitting on public lands and waters.” In his first week in office, he issued an executive order stopping all new federal leasing.

Biden’s initial nominee for Controller of the Currency, Marxist-trained Saule Omarova, is on record saying, “Here what I’m thinking about is primarily coal industry and oil and gas industry. A lot of the smaller players in that industry are going to probably go bankrupt in short order, at least we want them to go bankrupt if we want to tackle climate change.”

Sarah Bloom Raskin, Biden’s first nominee as the Federal Reserve’s vice chair for supervision, called for restricting financing for the oil and gas industry. Translation: Don’t let free markets decide what people want; the federal government knows best.

In May of this year, the administration pulled three previously-scheduled offshore lease sales in the Gulf of Mexico and off the coast of Alaska. The Washington Post called the move “a victory for climate activists intent on curbing U.S. fossil fuel leasing” that “effectively ends the possibility of the federal government holding a lease sale in coastal waters this year.”

The administration plans to let the nationwide offshore drilling program expire next month without a new plan in place: don’t expect any new leasing until a new president takes office in 2025.

Also in May, Interior Secretary Debra Haaland, whose department administers oil and gas leases, repeatedly refused to say that gas prices are too high. Wyoming Sen. John Barrasso asked her point blank: “Do you believe that gas prices are too high?” The obvious answer was: “Yes, senator, of course they are.” But instead, Haaland avoided answering the question. When Barrasso asked again, “It sounds you’re unwilling to say that gas prices are too high,” she still refused to say they were.

Biden himself let the cat out of the bag. At a Tokyo news conference, he admitted, “Here’s the situation, when it comes to the gas prices, we’re going through an incredible transition that is taking place that, God willing, when it’s over, we’ll be stronger and the world will be stronger and less reliant on fossil fuels.” Translation: Higher gas prices will force drivers to “transition” to electric cars.

This wasn’t just another of Biden’s many gaffes. It is his clearest statement yet of his administration’s policy.

Just as the government deliberately raised the cost of cigarettes to curb smoking, Democrats who are held in sway by the environmental left want to see gas prices rise so that Americans will stop using fossil fuels. Raising the cost of smoking doesn’t impact our national security, but raising the cost of fossil fuels does.

In 2018, the U.S. was the world’s largest oil producer and a net exporter of oil and gas, reducing the world’s dependence on Saudi Arabia and Russia. Domestic oil production’s importance is all too clear today with Russian oil sanctioned and Saudi Arabia wavering between the Russians and us.

Having shrunken our oil and gas industry, it’s pitiful now to see Biden offering to eliminate sanctions on Marxist Venezuela’s oil and allow Chevron to return to that country to resume oil production to make up for what he’s shuttered in the U.S.

Oil companies in this country can see the handwriting on the wall. Drilling new wells requires a lot of upfront money that will take years to pay back. Company executives are understandably reluctant to launch new ventures amid today’s poisonous anti-fossil fuel environment in Washington. Revenue from today’s high oil prices that could be invested in future production is instead being returned to shareholders.

Ignoring the world’s energy crunch, Democrats around the country continue closing coal-fired and nuclear power plants. Not to worry, says the environmental left: solar and wind power will fill the void. They’re whistling in the dark: we have no battery backup that can supply adequate power on windless nights.

Closing reliable, always-on fossil fuel and nuclear power plants without even the hint of a viable mass battery storage technology is like jumping out of an airplane while trying to assemble a parachute on the way down.

When you go to the ballot box this fall – walking since you may not able to afford to drive – remember who got us into this unprecedented mess.

Viewpoints and perspectives expressed throughout The Independent are those of the individual contributors. They do not necessarily reflect those held by the staff of The Independent or our advertising sponsors. Your comments, rebuttals, and contributions are welcome in accordance with our Terms of Service. Please be respectful and abide by our Community Rules. If you have privacy concerns you can view our Privacy Policy here. Thank you!

Click here to submit an article, guest opinion piece, or a Letter to the Editor

It is my understanding that 5 US refineries went under permanently during the pandemic. A 6th in Houston is currently up for sale since the parent company wants to exit the refinery business and will close it in 2023 if no one buys it. It is also my understanding the refinery capacity is the limiting factor in the US at this time not the availability of crude. Perhaps the closed refineries could be purchased and brought back on line. Perhaps not.

It is also my understanding that there are thousands of acres of drilling leases that are not being utilized by the lease holders. Some companies are even cancelling the leases they obtained when Trump was president. They apparently don’t think the reward from drilling is worth the cost/risk. They are satisfied with the status quo as they are all getting top dollar for their product be it crude or refined fuel.

everyone know he will not run = he’ll be lucky to avoid a nursing home in the next three years

member what Obama said = well you know what Obama said of sleepy joe – ‘Don’t underestimate Joe’s ability to f things up’ —- https://www.dailymail.co.uk/news/article-8630561/Dont-underestimate-Joes-ability-f-things-Obama-shares-private-doubts-former-VP.html

control population and watch many problems disappear. but we know government is not that wise

GET THAT OLD DAMM FOOL OUT OF OFFICE HE CRAZY WITH HIS BEADDING EYES HIS MIND IS SHOT TO HELL