”Free speech has been used by the Supreme Court to give immense power to the wealthiest members of our society.” —Noam Chomsky

”Free speech has been used by the Supreme Court to give immense power to the wealthiest members of our society.” —Noam Chomsky

Our government framework consists of three separate but equal branches: an executive, a legislative, and a judiciary, with the judiciary to act as our protector from legislative and executive encroachment. But how do we as a free people respond to judicial tyranny at the Supreme Court’s conflict with the Constitution and its lack of redemption?

The bellwether of our legal system is that 90 percent of attorneys are incompetent; they go on to become judges who are incompetent and from whose ranks incompetent Supreme Court justices (like Roberts) are chosen. As our republic fails, the blame can be laid squarely on our Supreme Court, the final arbiter of our rights.

We in the United States were never to be governed by money, but that has not been the vision of our final arbitrator, which has ruled that corporations are equal to people (Citizens United) and that the federal government can assess us with penalties and call it a tax, albeit an unlawful tax (Affordable Care Act). Ever since the passage of the 14th Amendment, the extreme wings of our political system have taken the view that it is their purpose to protect big business from the states and us. Accordingly, diversity statutes are being used to take litigation from state interests and remove them to the federal system in step with federal interests, which have traditionally sided with big business like banking, insurance, oil, and any other major business that operates across state lines.

But even these rulings are mild in the scope of this court’s redundant history of being stacked against our Constitution.

The cloud that hangs over this court demonstrates its usefulness as a tool of oppression, going all the way back to the appointments of Justices Joseph Bradley and William Strong by President Grant to change the outcome and ruling in the legal tender cases, which held that paper currency could not under our constitution be a legal tender for the payment of debts.

Some history

First, understand that paper notes are a representative currency. They represent dollars, but they are not dollars themselves. We use representative words to define objects.

For example, define a foot: A foot represents 12 inches. Define a yard: A yard represents three feet. Now, define a dollar.

The Coinage Act of April 2, 1792, established the United States Mint and regulated the coinage of the United States. Under this act, Congress established the silver dollar as the unit of money in the United States, declared it to be lawful tender, and created a decimal system for U.S. currency.

The dollar as defined by Congress may be found at Title 31, Section 5112 of the U.S. Codes. For example, the silver dollar consists of 31.103 grams (1 troy ounce) of 0.999 percent pure silver (see Section 5112 at [e], [1], and [2]). These constitutional metrics are the only constitutionally defined dollars. The paper currency is merely a representative currency. Article 1, Section 8 gives Congress this mandate.

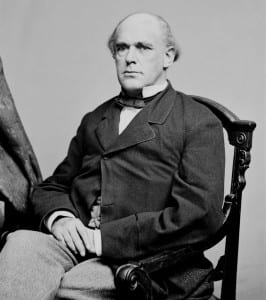

During the Civil War, with the Northern treasury lacking the finances to carry it on, President Lincoln nominated Salmon P. Chase as secretary of the treasury to find a way to finance the war. Chase created the U.S. Notes and made them legal tender in payment of all debts public and private. Then to insure the constitutionality of the Legal Tender Act, Lincoln appointed Chase as chief justice of the Supreme Court. But Chase surprised everyone when he wrote the decision in a challenge to the paper notes, Hepburn v. Griswold, 75 U.S. 603 (1870), declaring that under the Constitution paper notes could not be a legal tender, being in conflict with Article 1 of the U.S. Constitution.

To overrule this decision, Grant appointed Bradley and Strong, two railroad attorneys, to the Supreme Court, increasing the number of justices to nine, and the same question was brought back before the court in its next term when Knox v. Lee, 79 U.S. 457 (1871) reversed Hepburn v. Griswold.

Based on this president we now exclusively have a paper note as a legal tender, paper that is not backed by anything but our good faith in the government. The difference is that the U.S. Notes were a tax against us in favor of the government; they were also redeemable in lawful dollars. The Federal Reserve Notes are a tax against us by a private banking system for the benefit of the large banking interests, the Wall Street banks who we pay an interest to — first to the Fed, which then apportions it among its members — for the use of this essentially valueless paper. Granted, some of this interest is returned to our treasury, but the bulk is divided as spoils among the member banks. Additionally, these Federal Reserve Notes are redeemable in nothing; they circulate as Federal Reserve obligations only. So what is their value? We might as well trade cowry shells.

Better yet, let’s go back to using U.S. Notes and bypass the banks’ stranglehold over our lives through their debt currency and phony interest obligation.

A deviation from constitutional law, the Federal Reserve System also raises additional concerns: If Congress is mandated to coin the money and determine its value, does that allow Congress to give away this important constitutional obligation to a private money system?

The Supreme Court was stacked by Grant and treason was committed, but this is only one case I have documented. How many others exist? What additional usurpations have we been made to endure?

The Supreme Court’s perceptible mandate has been to protect big business interest at the extent of smothering the people’s will. The Roberts court has demonstrated this progressive mentality, ruling against common sense in favor of pseudo-economic theories through pseudo-legal maneuvers even though not one member of this seditious court is an economist.

When the Roberts court upheld the Affordable Care Act individual mandate as a tax, it actually overturned the constitutional mandate it swore to uphold and defend. As a lawyer, Roberts and the four liberals who supported him know that no governmental agency — not Congress, the executive branch, or even this treacherous court — has authority or power to tax us directly.

The income tax case of Pollock v. Farmers’ Loan & Trust Company 157 U.S. 429 (1895), affirmed on rehearing (158 U.S. 601 [1895]), was a landmark ruling in which the Supreme Court held that the unapportioned income tax on interest, dividends, and rents imposed by the Income Tax Act of 1894 were in effect direct taxes and were unconstitutional because they violated the provision that direct taxes be apportioned (Article 1, Section 9, Clause 4).

Pollock v. Farmers’ Loan & Trust Company is still valid law when direct taxes become an issue, as they did in the individual mandate, but because of the Sixteenth Amendment, it is no longer applicable to income taxes.

Roberts’s twisted argument is consistent with a moron attempting to defend himself and his erroneous view. Article 1, Section 9, clause 4 remains constitutional law even as Roberts ignores it.

“By a vote of 5–4, the Court upheld the individual mandate of the ACA as a valid exercise of Congress’s power to ‘lay and collect taxes’ (Art. I, §8, cl. 1),” Roberts, writing for the court, explained further:

“The Affordable Care Act’s requirement that certain individuals pay a financial penalty for not obtaining health insurance may reasonably be characterized as a tax. Because the Constitution permits such a tax, it is not our role to forbid it, or to pass upon its wisdom or fairness.

“Further, the Court ruled that while the section 5000A penalty is treated as a tax for constitutional purposes, it is not a direct tax, and therefore is not required to be apportioned among the states according to population. The Court concluded: “A tax on going without health insurance does not fall within any recognized category of direct tax … The shared responsibility payment is thus not a direct tax that must be apportioned among the several States.”

Roberts shared responsibility concept is a dangerous slope he descends. Under his socialist view, it could be used to force us to relinquish any amount of our income Congress deems necessary to feed and clothe our neighbors and individuals on welfare. We have no duty to share responsibility because Congress wants everyone insured. There is no congressional authority to impose this socialist concept on us! In fact, the Fifth Amendment forbids it.

The Fifth Amendment requires, ”nor shall private property be taken for public use without just compensation.” Certainly it may not be taken for private use!

This notion of shared responsibility is the dream of Karl Marx taken right from his communist manifesto. It is the same concept Hillary Clinton advocates, that it takes a village to raise a child, and smacks of the socialist euphoria, “From each according to his ability, to each according to his needs” (shared responsibility).

Roberts is a living illusion, a socialist fraud pretending to be a constitutionalist.

The taxing authority of our government

Article 1, Section 8, Clause 1 of the United States Constitution grants the federal government its power of taxation. This clause permits the levying of taxes for two purposes only: to pay the debts of the United States and to provide for the common defense and general welfare of the United States. Taken together, these purposes have traditionally been held to imply and to constitute the federal government’s exclusive taxing and spending power. But this power is limited by Article 1, Section 9, Clause 4 of our Constitution, which precludes Congress and the Supreme Court from laying this tax directly against us, the individuals! Roberts failed to address this. His mischaracterization that this direct tax is not a direct tax is, to be kind, like a moron making an excuse for his idiocy.

It is an unconstitutional tax! And the Roberts court is fully aware of its treachery.

Roberts and the four other “justices,” in their circuitous thinking (four were liberals), would have us believe a tax that is assessed against the individual by Congress is not a direct tax. Then what is it? There are only four type of taxes known to mankind: excise taxes (which must be uniform among the states), duties, imposts (which don’t apply here and which also must be uniform among the states), and direct taxes.

An excise tax is one that can be passed on to a consumer; a direct tax is one to be paid directly by an individual, which is how the individual mandate is carried out.

To be clear, the individual mandate is not an excise tax. It is not a duty laid or an impost tax. It is a direct tax against the individual laid because he failed to buy a required insurance, and no amount of deception or feigned ignorance from this court will change its makeup.

While the liberal left of this court joined Roberts, Justices Scalia, Kennedy, Thomas, and Alito dissented.

So we have a federal court based on expediency and not the rule of law. To me, that is the very essence of tyranny. If we are to be ruled by political interests, then justice has become a mere illusion.

Consider the words of Harvard law professor Noah Feldman: “Every generation gets the Constitution that it deserves. As the central preoccupations of an era make their way into the legal system, the Supreme Court eventually weighs in, and nine lawyers in robes become oracles of our national identity.”

You explained it in a way that’s plain as day Mr. Ferm. Thanks for the reminder.

But as one Wantabe recently said; “Ho Ho Ho! Really, at this point,what difference does it really make? A conflict with the true meaning of the Constitution? Hogwash, The laws of the land were written on a stupid piece of old paper without any lawyer clause omissions”. i.e. You May,, Perhaps, etc. Isn’t that right Mr. Roberts? Right?

“90% of lawyers are incompetent.” Says the guy touting a JD from a diploma mill.

Trump, You obviously have no research Skills, So I will let your comment go for what it is “someone who can’t attack the message” you also are not very good at attacking the messenger!

FYI, although I owe you no explanation Bernadean was not a diploma mill any more then any law school is today! Spend more time looking up facts and less time trying to disclaim truthful research….